BeamX Token Economics

The BEAMX Token

BEAMX token is a Confidential Asset issued on top of the Beam blockchain with a fixed emission of 100,000,000 units (except for the lender of a 'last resort' scenario). The BeamX DAO Core contract manages BeamX token emissions.

BEAMX is the governance token for the BeamX DAO. Users can earn BeamX tokens by participating in the DAO activities: providing liquidity to the DeFi applications governed by the DAO or participating in the governance process.

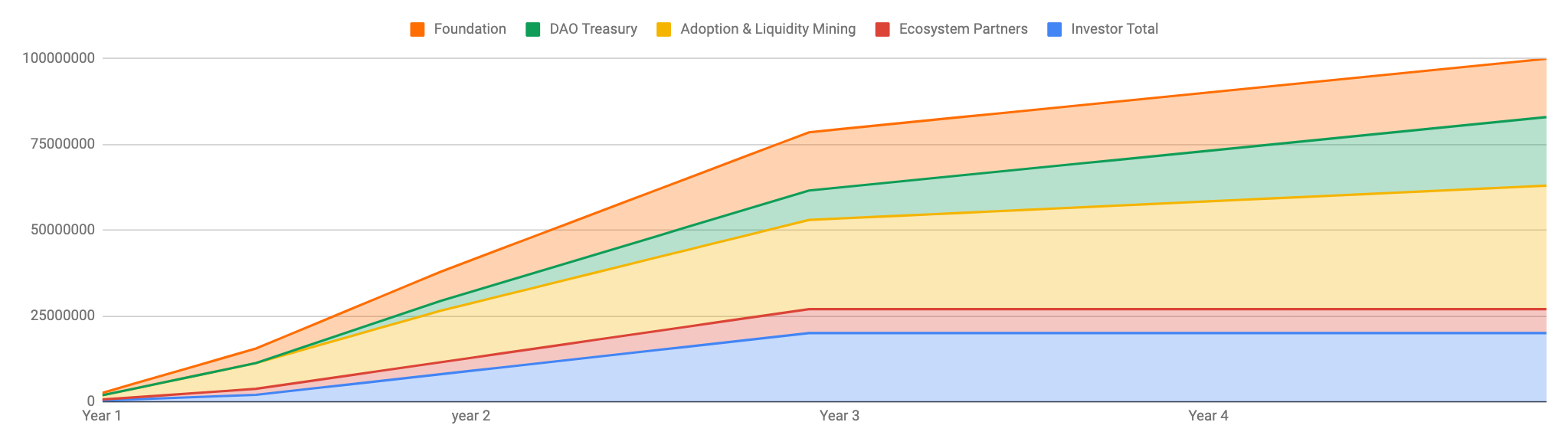

BeamX tokens circulate on a block by block basis, spread over four years with slightly different emission schedules for each tranche:

DAO Treasury (20%): The BeamX DAO has a dedicated treasury to incentivize and compensate community-driven development. The DAO, e.g., BeamX stakeholders, manage the Treasury. The DAO Treasury will start receiving tokens six months after the contract launch and receive BeamX tokens for four years.

Liquidity Mining (36%): The DAO plans to release and adopt several DAPPs. The majority will rely on locked liquidity providers that staked Beam coins or other Beam Confidential Assets in the BeamX DAO DAPPs liquidity pool. Locked liquidity providers will earn BeamX tokens as rewards. The DAO will allocate BeamX tokens to Liquidity Mining over four years to ensure long-term support of the ecosystem.

Ecosystem Partners (7%): Allocating BeamX tokens to Ecosystem Partners over four years is crucial for helping incentivize innovation and increase the use and exposure of Beam and BeamX. Ecosystem Partners will motivate existing projects to integrate into the BeamX platform and ensure long-term support of the ecosystem.

Foundation (17%): The Beam Foundation will also receive BeamX tokens as part of the BeamX DAO. Transitioning to a DAO that fully self-governs both the Beam protocol and BeamX ecosystem will be gradual and take some time. The Beam Foundation will have voting power via BeamX token allocation to ensure a smooth and safe transition, with majority distribution going to the core team and future hires. The Beam Foundation will stop receiving the BeamX tokens after two years.

Investors (20%): The DAO has raised initial funding from a closed group of accredited investors to implement the functionality and essential applications. Future investment rounds could be in the pipeline and may execute by the DAO through a voting process. Investors stop receiving BeamX overs after two years.